Roth 401k paycheck calculator

As of January 2006 there is a new type of 401 k -- the Roth 401 k. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period.

Traditional Vs Roth Ira Calculator

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

. Are for retirement accounts such as a 401k or 403b. It is mainly intended for use by US. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Estimated annual retirement income Traditional 401 k Roth 401 k 6031 6853 A Roth 401 k could provide additional income of 822 per year during retirement. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Calculate your earnings and more A 401 k can be an effective retirement tool.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. When you retire and start withdrawing money from a traditional IRA or 401 k that money you pull is a paycheck and is taxed as income. So if you elect to save.

For the Roth 401 k this is the total value of the account. Years until you retire. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Each has its own benefits. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. You may have to pay income tax on that.

Compare 2022s Best Gold IRAs from Top Providers. 1 The value of the account after you pay income taxes on all earnings and. Personal Investor Profile Download.

Contributions made to a Roth 401 k are made on an after-tax basis which means that taxes are paid on the amount contributed in the current year. Traditional 401 k plan withholding This is the percent of your gross income you put into a tax deferred retirement account such as a Traditional 401 k. Second multiply your gross income per pay period by the.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Subtract any deductions and. Traditional 401k and your Paycheck. The Roth 401 k allows contributions.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. This calculator helps you estimate the earnings potential of your contributions based on the amount you invest and the expected rate of annual return. Back to All Calculators.

Roth Retirement Savings Plan Modeler. Reviews Trusted by Over 20000000. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Roth IRA distributions An IRA distribution or. As of January 2006 there is a new type of 401k contribution. The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the expected annual return of your investments.

100 Employer match 1000. A 401k can be an effective retirement tool. When you make a pre-tax contribution to your.

This number is the gross pay per pay period. 1 The value of the account after you pay income taxes on all earnings and tax-deferred contributions and 2 The accumulated value of. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

While increasing your retirement. Ad Strong Retirement Benefits Help You Attract Retain Talent. For the traditional 401 k this is the sum of two parts.

Learn How We Can Help Design 401k Plans For Your Employees. For the traditional 401 k this is the sum of two parts.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401 K Calculator See What You Ll Have Saved Dqydj

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Might Make You Richer Millennial Money

401k Calculator Paycheck Outlet 50 Off Www Ingeniovirtual Com

The Ultimate Roth 401 K Guide District Capital Management

401k Calculator Paycheck Online 59 Off Www Ingeniovirtual Com

Roth 401k Roth Vs Traditional 401k Fidelity

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

How To Calculate Roth 401 K Withholding

Traditional 401 K Vs Roth 401 K Ubiquity

Solved After Tax Roth 401 K Employee Deductions Company Contributions

Traditional Vs Roth 401 K Where Should I Be Putting My Money Detterbeck Wealth Management

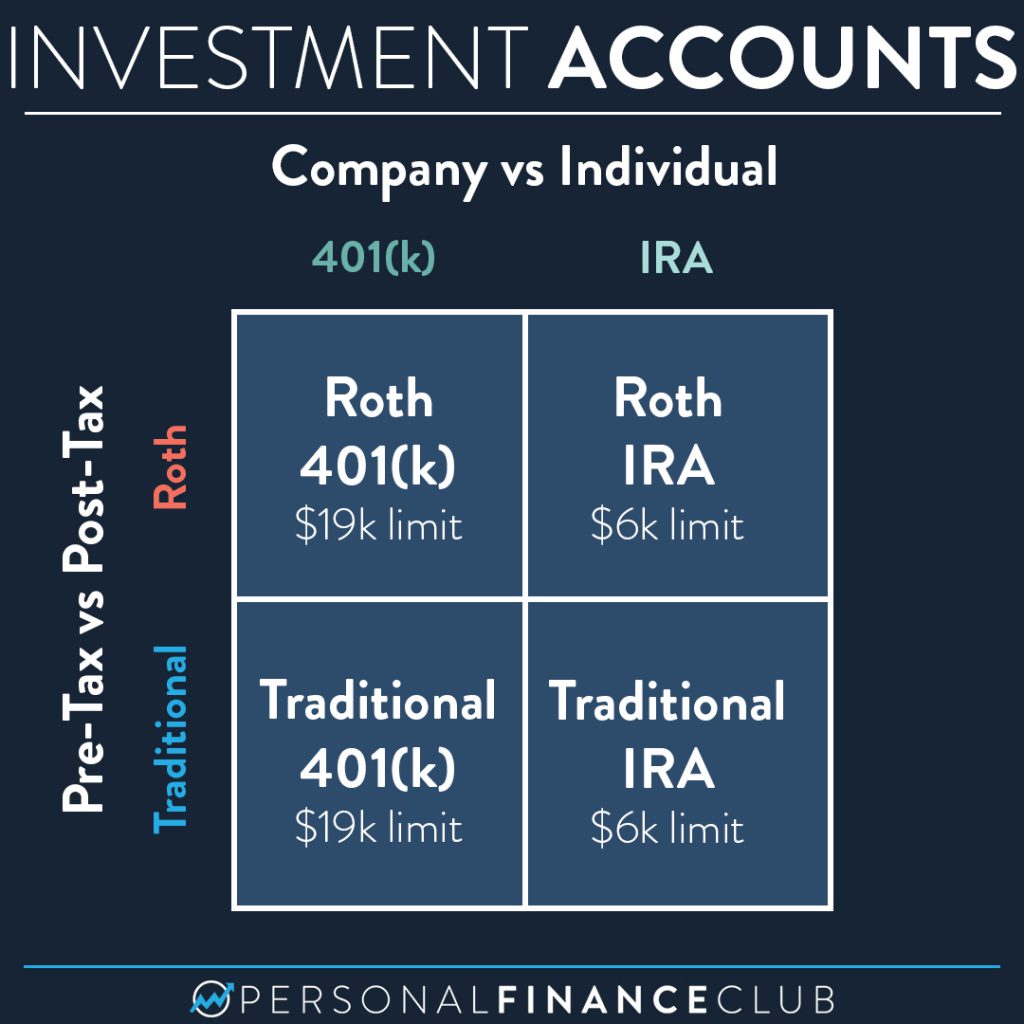

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Traditional Vs Roth Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator